US Met Coal Price Assessments Are Getting Stupid Again

It's Time to Return to Annual Fixed Price Contracts

Morning everyone…taking a break from finishing up the outlook today to rant like a crazy person jot down some thoughts on the state of met coal industry price assessments. This got pretty long, hence it’s a full post rather than a chat…here goes.

From time to time, it’s important for us all to recognize that the trade journalists who cover the mining industry – including the one writing this post – are not in the mining business.

We don’t sell coal…we sell subscriptions.

And because of that, we sit on the outside of the industry looking in…just hoping to catch a glance of what really happens behind the scenes.

Most of the time, that’s all most of us need to get a sense of how markets are behaving. A check on price here…a data point on stockpiles there…and maybe even a couple comments on downstream demand to fill out an article.

But the real truth is that there is no substitute for on-the-ground information in this business.

You can’t find it behind a desk, or on the other end of a phone, or in some white paper that an analyst writes in an ivory tower surrounded by screens and trade flow models.

You can only get it by going out there and selling product.

When trade journalists get this information wrong at the bottom of cycles, it might not matter to the end users and traders who are feeding them the lowball numbers – which they then use to their own advantage.

But it sure as hell matters to the Central Appalachian coal miners who might lose their jobs.

We’ve had 3 bankruptcies so far that I know about – Bens Creek, Coking Coal LLC, and more recently (and painfully for some of you) Corsa Coal.

And if prices stay down here, we’ll see a few more.

So when I hear about the third coal mine fire in six months – one that will likely result in a 6 month/1.5 Mst outage just due to carbon monoxide levels – and the trade magazines have the audacity to mark US coal indices DOWN the following day…well needless to say I get pretty damn fired up.

Literally every producer contact I have spoken with over the past week has told me some version of a similar story – they continue to get inquiries in the $190-195/tonne range for low or mid-volatile cargoes, but they don’t have any to sell.

Even A-grade high-vol coal availability has significantly tightened since before the holidays, and now with Leer South down indefinitely, the market is facing a shortage for this restocking season.

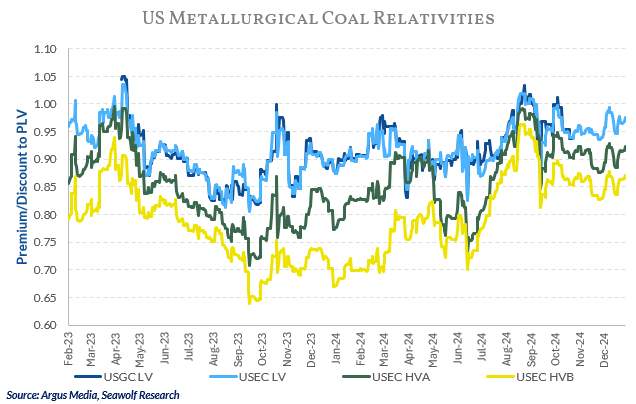

Yet yesterday’s physical assessments came in down $2.50/t across the board for US East Coast LV/HVA/HVB prices at $185/177.50/167.50.

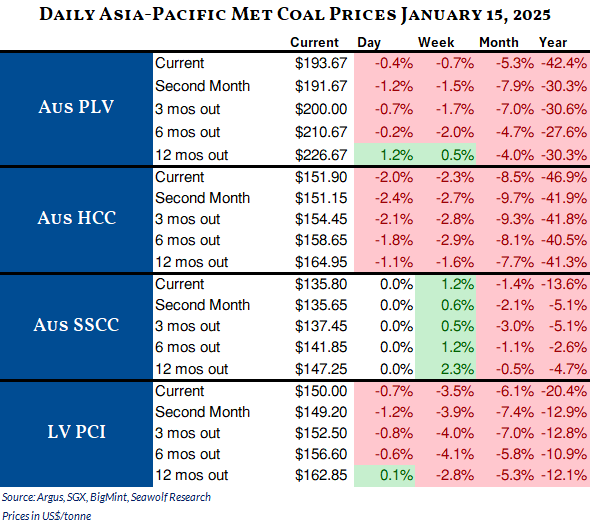

Now I’m not denying that Asia-Pacific markets are in the doldrums…for all intents and purposes, the PLV market is China, and that steel industry is in a world of hurt.

But even there, high quality mid-volatile coals are commanding a premium over PLV due to Indian demand. And that in turn is forcing Indian procurement officers to look to the US for relief.

In years past, similar dynamics would result in US coals commanding a significant premium over their Australian competitors in the seaborne market…after all, if you want to incentivize swing supply into the market, you have to pay up to get it.

But Argus and Platts don’t seem to be recognizing that very obvious trend at the moment…and I can only surmise that is due to their unlimited access to buyers angling to jawbone down the market, and very limited contact with actual coal sales teams, whose contract terms prevent them from commenting in detail.

Worse still, these seaborne spot assessments for met coal – which barely constitute a measly 2% (!!!) of global met coal sales – affect what producers receive for their seaborne contracts!

That is absolute nonsense.

US domestic steel producers have to pay a premium to keep US coking coals onshore, and they do so on annual fixed price contracts.

The rest of the global steel industry should do the same, as that would go a long way toward eliminating the constant fight against price volatiliy.

And if that means Argus and Platts sell fewer price subscriptions, so be it…maybe try just reporting the damned news instead.

Like we all pay you to do.

I spoke w/ Platts this morning with the same line more or less. They haven't even mentioned the Arch fire in their publications yet!! At least McCloskey reported on it.