Good afternoon, Coal Traders! If you’re in the US, I hope you’re having a nice MLK and Inauguration Day holiday. I’m using the day to catch up on some coal research. I haven’t updated on the thermal coal markets in about a week, so today I’m releasing a slightly longer-than-normal note on thermal markets - please let me know if you have any questions.

I’ll also be releasing another note tonight on an under-the-radar topic for coal miners (45V tax credits in the US). It’s a little wonky to see how coal miners could benefit from 45V, which is fundamentally a hydrogen tax credit, but the latest rule means that “gassy” US coal mines could add quite a lot of incremental revenue if they can collect and sell natural gas on their properties. In addition, I’ll get out my first coverage of Yancoal (ASX: YAL) tomorrow. YAL reported pretty good operational performance today and added another boatload of cash to the balance sheet, but the handwringing over a potential Kestrel acquisition is keeping buyers away and the stock dipped. More to follow!

Thermal Coal Market Update

Since the start of the year, API2 coal prices have been dipping due to warmer weather, lower gas and electricity prices and elevated stockpiles. Yet, current month (January) API2 prices are up a few dollars on the week. Fundamentals are still pretty weak out there as gas prices slid over the last week and coal stockpiles at ARA are standing at 3.95 Mmt, a multi-year high. Coal stockpiles at the Richards Bay Coal Terminal (RBCT) are also elevated, currently exceeding 4 Mmt and 17% higher y/y, according to Argus. Indian spot purchasers have not yet been tempted to buy up South African coal cargoes despite the low prices. Aside from lower thermal coal demand across Asia due to warmer temperatures, Indian industries associated with steel production and construction such as sponge iron and cement are reportedly buying less coal.

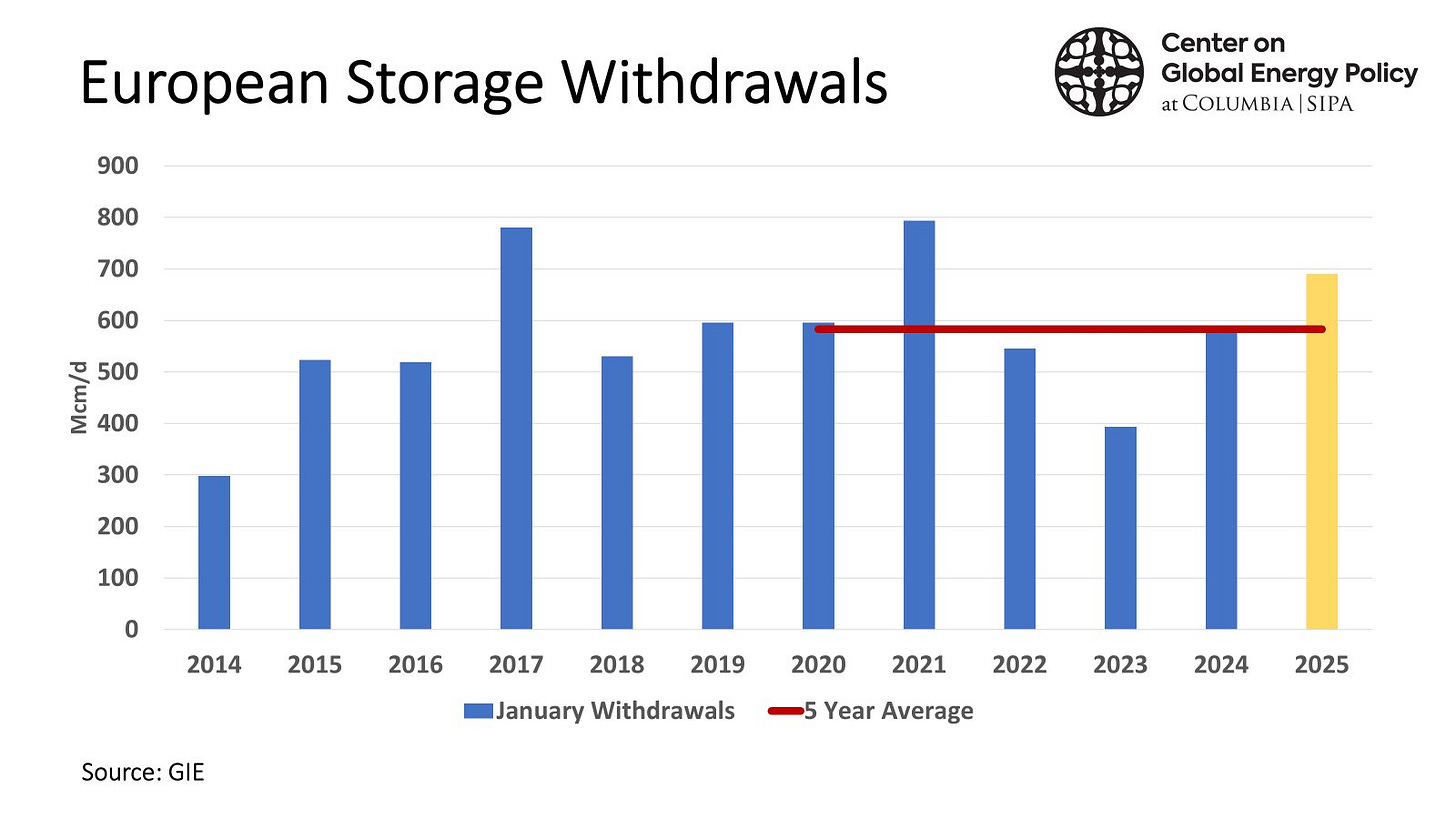

European gas prices dipped a bit over the last week, but prompt prices are still fairly strong at around the €48/MWh level currently (~$14.50/MMBtu). Storage withdrawals have been running at high, if not exceptionally high levels through the first 3 weeks of January (see chart below). Two days in January exceeded 900 Mcm/day, which is nearly 20% off of the daily peak set in 2018, but impressive nonetheless. At this pace, European storage will end January at 59 Bcm, which would be the lowest level since 2022 (41 Bcm). As gas prices are part of my thesis for API2 prices that should ride a little higher than most expectations, I will continue to track them closely.

The German hard coal importers association, VDKi, put out an interesting article last week arguing that Germany’s coal burn would have been higher except for the country’s coal reserve policies. The 7 GW of coal-fired power plants that are in reserve in Germany were not used during periods of Dunkelflaute (the “dark doldrums”) in November and December. Power plants in the reserve program can only be used to ensure “system security,” not to reduce electricity prices. As regulators did not flag system security concerns, the plants didn’t run, even though prices spiked to over €900/MWh for several hours in December. Those high prices negatively impacted industrial production in certain regions and likely won’t make household consumers very happy. Sweden and Norway also saw high electricity prices as they typically depend on power imports from Germany during the winter months. I’ll let you all comment on this post about how brilliant this Germany coal reserve policy is, but for the meantime, it’s a market quirk that I’ll watch as it will tamp down the upside for European coal burn.

It’s not all bad news out there for thermal coal prices. In fact, a couple of sources have told me that in the last week European thermal coal buying activity picked up a bit as lackluster renewables output increased the call on coal- and gas-fired generation. Spot activity is also picking up in the Chinese market as buyers seek 5,500 NAR material ahead of the Chinese New Year, which starts early this year (29 January). Some small mines have already closed ahead of the holiday and so buyers are stockpiling coal early. But once the Chinese New Year begins, expect the Asian thermal coal markets to be very quiet (barring any major news).

Australian high-cv 6,000 NAR coal also picked up a few dollars per tonne over the last week, topping $118/mt. Demand from NE Asia and rising competition from Colombia, Mongolia and other exporting countries is keeping a lid on prices for now, but we’re also at price levels that are causing some mines to run at a cash loss. Supply hasn’t fallen out of the market yet, and we could see prices drop again, but over the longer-term, current price levels are unsustainably low.

In other news, Goldman came out with a note saying that the recent decline in thermal coal prices was justified by fundamentals and they pointed to high coal inventories, warmer weather in northeast Asia and key exporters that are keeping the market well-supplied with coal. All of the things that we’ve been highlighting here at TCT. Goldman reiterated its previous forecast of $105/mt for API 2 and $125/mt for fob NEWC for Cal-25. Not far off from my own forecast, which put the calendar year 2025 averages for API2 and NEWC at $109.50/mt and $118.25/mt, respectively.

-JA