The Donkin Mine & Morien Resources

A late stage cyclical indicator or a potential investment?

Morien Resource Corp. (MOX.V) is a “single event stock” according to CEO Dawson Brisco. You can listen to his May 2022 webcast here. The single event is the reopening of the Donkin Mine which Morien has a royalty interest in.

The Donkin Mine is located on Cape Breton Island, Nova Scotia, Canada:

Background

The Donkin mine was the dream of late great coal operator Chris Cline, who founded Foresight Energy LP, and later acquired Glencore’s 75% interest in the mine back in 2014. Cline died in a helicopter accident in the summer of 2019, but before his death he sold Foresight to Murray Energy Corp. and turned his focus towards Canada.

The Cline Group, along with subsidiary Kameron Collieries (named after Chris’s daughter Kameron, who also died in the crash), owns and operates the Donkin mine which has been idled on care and maintenance since March 2020. Production at Donkin started in February 2017, operating through it’s twin tunnels which extend over 3 kilometers underneath the Atlantic Ocean.

Recent Developments

A local politician went on record in June, reporting that plans are in place to restart operations at Donkin sometime this fall. Applications for the required permits have supposedly been filed with provincial regulatory authorities and the company has been hiring ahead of the resumption of mining operations. You can read more about this here.

I’ve been told there are numerous “new and shiny trucks” on site, and there’s even been a sighting of Xcoal’s CEO, Ernie Thrasher, who arrived by helicopter at the site of their export terminal nearby. More on Xcoal and Ernie later.

Activity at Donkin has definitely picked up and it makes a lot of sense given the current energy crisis and European sanctions on Russian coal. The deadline for importing Russian coal into Europe is Aug. 10, and non-Russian sources will be in high demand once the deadline passes.

As you can see in the API2 Rotterdam futures chart below, prices have been rallying in the run up to the deadline, in spite of the inventories growing to near capacity levels:

If there was ever a time to reopen Donkin, which has typically been seen as a late cycle indicator, now is the time to do it. With the stage hopefully set, let’s dig into the details of this mine and eventually figure out what it means to Morien Resources.

Geology

The Donkin Mine extracts Carboniferous aged coal measures from the Sydney Coalfield of Nova Scotia. The coal measures extend to the north and northeast from Cape Breton Island, mostly beneath the Atlantic Ocean. The first coal mine in N. America was reportedly located in Cape Breton. Surface and underground mining has been mostly continuous in the region for more than 150 years. Details herein are obtained from an Xstrata pre-feasibility report written by Marston & Marston, Inc. and dated June 2011; linked here.

Up to 11 coal seams have been identified in the Donkin area. The Harbour, Hub, and Lloyd Cave seams are identified as being candidates for production, but as far as I can tell only the Harbour has been mined to date at Donkin. The Harbour seam is located at the base of the two existing tunnels and most of the coal quality data I’ve seen is associated with this seam. The Hub seam, if feasible, would be accessed through two proposed slopes driven from the Harbour seam.

There is a severe lack of recent exploration drilling associated with this mine due to it being underneath the ocean. As you can imagine, drilling into these seams from above could significantly sterilize the reserves due to water penetration and flooding.

The Harbour seam appears to be approx. 1.9 to 3.5 meters thick. If you think of the current Cape Breton coastline, it is highly variable with bays, rivers and dunes. The ancient depositional environment was equally or more diverse and the sedimentary layers are therefore not uniform by nature. As a result, the Harbour seam has a highly variable roof which often turns into an unindurated shale with a crumbly habit and has proven to be quite hazardous with numerous rockfalls reported.

Since production commenced in Feb. 2017, there has been 12 reported roof fall incidences. There have been no injuries to date due to roof falls, and the high risk areas have apparently been identified by operational staff. Kameron Collieries and The Nova Scotia Dept. of Labour have been working with US Mining Safety and Health Administration (MSHA) as outside experts to properly asses ground control procedures, and roof fall mitigation measures at the mine.

Following the roof falls during Feb. 2020, MSHA consultants were not able to assess the situation due to Covid-19 related travel restrictions. This is noted as one of the reasons production was temporarily suspended at Donkin due to “geologic conditions.” But I’d like to note that seaborne thermal prices were approximately $50/mt at the time and I’m sure poor economics had something to do with it.

Mining & Production

Mining methods to date have been through conventional room and pillar methods utilizing 6 continuous miner (CM) units. The main development area runs along the strike of the Harbour seam, east and west of the access tunnels. The production panels were driven down dip to a depth of 600 meters.

The Donkin mine is currently permitted for run of mine (ROM) production of 3.6 million tonnes (Mt) annually (Mtpa), which would produce approx. 2.83 Mtpa of clean saleable product (assuming a 78.6% wash yield). With 6 CM units and adverse roof conditions, I think full production is more likely in the range of 2.8 Mtpa ROM, and 2.2 Mtpa clean. Given these production rates and likely reserves, Donkin’s life of mine (LOM) would last at least into the mid-2040’s.

There was talk of installing a longwall (LW), which The Cline Group is known for, but I’m assuming the permitting for a LW operation would be arduous given the subsidence issue which invariably occur, and the slight technical issue of being underneath the Atlantic Ocean! Interesting enough though, a LW would eliminate most of the adverse roof condition issues. But I have no idea if you can subside beneath the ocean safely. Moreover, I’m assuming the lead time to purchase a new LW system would be on the order of 12-24 months.

In terms of mining costs, based on an old Wood Mackenzie report and adjusted for inflation (+20% relative to 2019), full production costs should be close to the following (in US Dollars):

Extraction: $37.29 per ton

Coal Prep: $3.95

Transportation: $8.52

Port Handling/Transloading: $4.26

Overheads: $1.42

Total = $55.43 per ton

Lower volumes during any ramp-up in production due to development or mine rehabilitation will obviously lead to higher cash costs per ton. Moreover, due to tough mining conditions, ventilation issues, roof falls, etc. these costs estimates are likely low. CAPEX during the first year or so will be high due to exploration and development, getting mining equipment running efficiently and mine rehabilitation after being idled for over 2 years. Lastly, these costs do not include royalties to Morien, which will be discussed later.

Overall, Donkin’s mining costs are on the high end of the cost curve relative to other high calorific value (CV) coals in the Atlantic Basin, but on a delivered basis into Europe their transportation advantage goes a long way in making them quite competitive:

Moreover, in today’s pricing environment basically any new supply is in the money. And if you look around the world for sources of incremental supply, they are very hard to find.

Washing & Coal Quality

The wash plant is capable of processing 650 tons per hour (tph) and features a single-stage, large diameter, dense medium cyclone to process crushed coal, and spirals to process mids, along with typical flotation to beneficiate the fines.

Based on the washplant simulations from the Xstrata report, referenced above, and data from Wood Mackenzie, the Donkin reserves would make a good high heat and high sulfur thermal product, or a low-rank coking coal with high volatile matter.

This coal has the following thermal characteristics:

CV Btu/lb (gar): 13,000-13,500

Ash (ad): 2.8-3.0%

Total Sulfur (ad): 2.3-3.0%

Volatile Matter (ad): 39%

Total Moisture: 6-10%

Chlorine: relatively high

And the following coking characteristics:

Crucible Swelling Number (CSN): 7-8

Fluidity: > 20,000 ddpm

Coke Strength after Reaction (CSR): 25

It has low ash, low phosphorous, high CSN and high fluidity however, the low CSR is typical of a semi-soft coking coal.

In today’s market there is no debate, this coal will be sold to primarily European utilities as a high CV thermal product. It would take a hit on the sulfur, but the heat premium would offset that discount somewhat. I’ll touch more on market economics and pricing later in this article.

Transportation

Donkin is located within about 20 miles of a deepwater port in Sydney, Nova Scotia. The Atlantic Canada Bulk Terminal is owned and operated by Provincial Energy Ventures (PEV), which is an affiliate of coal trading giant Xcoal. This export terminal describes itself as “the most eastern mainland port in North America.” The PEV terminal “operates a wharf that once served the largest steel plant in the British Empire,” which is now dismantled. Click here for PEV’s website.

Recent dredging took the entrance channel to Sydney Harbor down to a depth of 55 ft, allowing entry of deep draft vessels. Panamax drybulk vessels of 60,000 deadweight tons (DWT) capacity can currently utilize the Atlantic Canada Bulk Terminal. But it should be relatively easy to dredge/drill the pier area deeper for Capesize vessels, especially if sales to Asia are considered. Due to close proximity to European ports, specifically the Amsterdam-Rotterdam-Antwerp (ARA) port where API2 futures contracts are delivered, the ocean freight will be considerably cheaper than competitor operations with ports on the eastern Atlantic seaboard or the Gulf of Mexico. It is generally thought to cost approximately $7 to $12 per metric ton for the voyage from Cape Breton to Rotterdam. This compares to today’s rates of approx. $20/mt from the US East Coast and $26/mt from the Gulf of Mexico.

Getting the coal from washplant to port will unfortunately require trucking. Nobody likes trucking coal; the local community hates having roads clogged with coal traffic, and management hates having to pay for expensive and inefficient trucking costs. Given proximity to the ocean, I wouldn’t be surprised to see some sort of barging solution developed once this mine is operational and a proven producer.

The takeaway in terms of logistics is these assets are competitively situated for cheap transportation of coal. Xcoal is one of the largest coal traders on the planet and I’m sure Ernie Thrasher is able and willing to make a market for Donkin’s coal utilizing his terminal less than 20 miles away. It’s a match made in coal heaven, as they say.

Coal Pricing

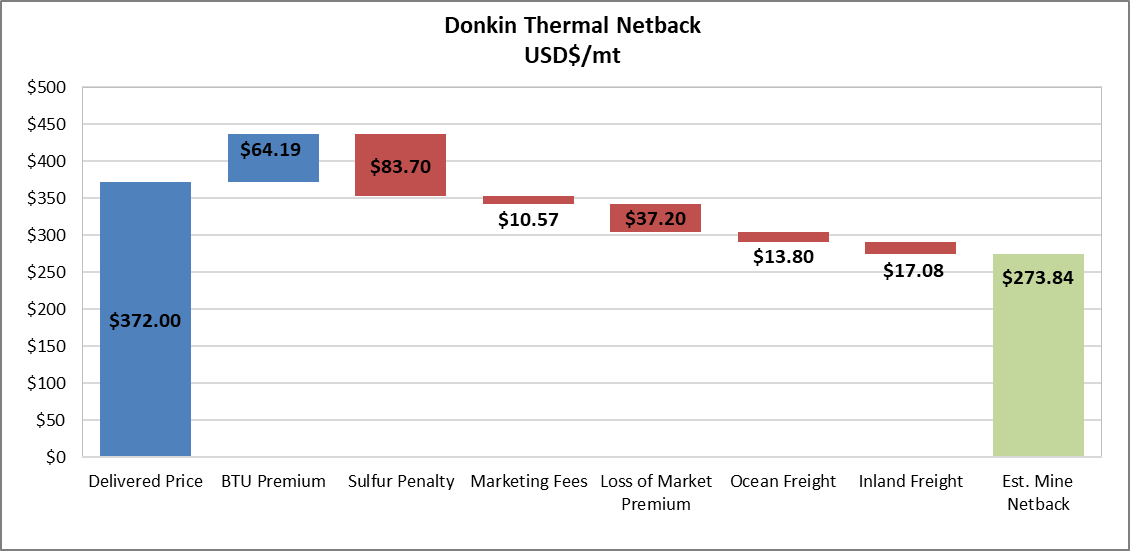

The following waterfall chart shows my price estimate of the potential netback for Donkin coal in the European API2 market, at today’s spot pricing:

It is rare for a producer to capture 100% of the premium in the spot market, especially for a new product. The sales realization above is therefore not quite realistic. But more importantly, there is an interesting dynamic between Xcoal the trader, and Cline the producer, which we should consider.

I’m assuming Xcoal will market and handle 100% of sales for Donkin since they own the export terminal 20 miles away, and their business model is making coal markets as a third party trader. I don’t think Cline will attempt a spot market based sales strategy, given the significant amounts of CAPEX they’ve invested in this project since 2015. Instead, they will attempt to to lock-in sales prices, and profitable margins, by entering into supply contracts with Xcoal to try to recoup their investment to date and de-risk the reopening and development CAPEX.

In this scenario, Xcoal would assume all market and transportation related risks. They would hedge their market risk using API2 derivatives to sell the forward curve, and insure against transportation losses, capturing a meaningful spread in the process (perhaps in addition to a marketing/sales fee per ton).

The length of the contract is one factor determining how much discount to the spot market Cline will have to “pay” forward. A second factor is the historical performance of the mine and the associated execution risk which Xcoal would be taking on by betting on Cline to deliver and ramp up production without incident during the contract period. For that risk, they will want to provide themselves with ample reward to make it worth their effort.

It’s pure guesswork trying to determine what the price of Donkin’s sales contract would be in this scenario. But let’s run the numbers from Cline’s perspective:

Let’s assume they’ve already spent $200 million on development since 2015, it’ll take another $50 million to get it back into production, plus another $50 million in CAPEX to get it ramped-up over the next 2 years to full production.

Cline is therefore $300 million is the hole by late 2024, using big round ballpark estimates.

If they start production in 2022, let’s assume it’s an immaterial amount and we count it as inventory for simplicity purposes, then

2023 sales are 1 million tonnes

2024 sales are 2 million tonnes

Given this simple scenario, a sales price of approximately $170/mt would get Cline out of the hole by the end of 2024, by my calculations. If I’m viewing it from Cline’s perspective, this price is likely their goal, at a minimum.

The problem is, traders like Xcoal have all the power in a situation like this, especially when they own the port terminal required to transload your product to market. By selling the API2 forward curve, Xcoal would be taking on a lot of margin and basis risk, in addition to operational performance risk, as previously mentioned.

From Xcoal’s perspective, they would probably prefer to enter into an index based supply contract whereby Cline earns a sales realization at the API2 index price (adjusted for BTU premium and sulfur discount), less a marketing fee, and less transportation costs. This sort of offtake arrangement would include some markups for operating the port, managing logistics and insuring against transportation losses, as well as some discount to the spot market because, as I mentioned earlier, it’s rare to capture 100% of premium in the market.

Under this scenario I get the following waterfall netback price estimates:

This result is tremendously better for Cline (and Morien). It’s counterintuitive to think they could do better than their basic goal, but under this scenario they are taking 100% price risk instead of locking in profitable margins; more risk equals more reward (if everything works out).

Finally, there’s a third option in the Cline and Xcoal supply to sales dynamic: Xcoal could find an end user for Cline and enter into a bilateral supply contract whereby Cline and the end consumer share market risk and Xcoal simply manages the trade. As you can see, there’s a lot for each party to consider and it’s difficult to prognosticate where prices for Donkin’s coal will end up.

Morien’s Royalty Revenue

Morien receives a gross production royalty of 2% on the first 500,000 tonnes of coal sales, and 4% of any coal sales above 500,000 tonnes per quarter. Therefore, if quarterly production is roughly equivalent throughout any given year, Donkin would need to sell over 2 million tonnes annually to earn any royalties at the 4% rate. The first 2 million tonnes would earn royalties at the 2% rate and any volumes above that would earn at the 4% rate.

Given the simple production model in the pricing discussion above, Morien’s Royalty would be the following at spot rates, index-linked contracting and/or locked-in contracted pricing scenarios, which I estimated above:

Morien is really held hostage here by the 2 Mtpa and 2% royalty rate constraint. Once Donkin gets above the 2 Mtpa threshold, the incremental volumes at the 4% rate provide a material step up in revenues. If we assume they do a little better than above, but still well within reason, you can see how the incremental sales above 2 Mtpa really starts to impact the top line, refer below:

The critical question then is whether or not Cline can ramp production up beyond the 2 Mtpa constraint or not. As mentioned earlier, a longwall has been discussed as a possibility and that would definitely be a boon to Morien’s outlook. A typical longwall produces around 5 Mtpa. But the technical issues involved with subsiding beneath the ocean, getting approval to do so, and LW availability seem to me like a low probability outcome. Without a LW, the only remaining options are to simply add CM units, and/or increase the amount of operating shifts per week by working weekends, for example.

Given Cline’s substantial investment to date, I’m sure they will wait and see how things progress before adding new equipment and/or paying overtime for more shifts. Keep in mind, this mine is still in it’s development phase. From an engineering standpoint there likely remains a lot of work to do in order to iron out the inefficiencies and turn it into a well oiled machine. Cline will first and foremost be concerned with getting it humming along and developing strategies to mitigate any further disruptions to production, such as roof falls, before worrying about maximizing production.

Summary

The odds are generally good that Donkin will in fact resume mining operations, and Morien’s stock should see some buying activity if/when this occurs. Political opposition doesn’t sound like a huge risk, at least when I asked around a bit. There appears to be political urgency to send fossil fuels to Europe at the moment, so maybe the timing is perfect for a reopen.

Most of the risk, in my view, is associated with production and sales volumes. The question of whether The Cline Group can finally execute at Donkin remains to be seen. Based on their past success, we should probably give them the benefit of doubt when it comes to Donkin.

Now that we have a high and low production scenario, along with 3 possible pricing mechanisms, let’s check out the range of potential royalty revenues for Morien and put those figures into context for the stock.

At the current share price of CAD $0.57/share, and with 50.5 million shares outstanding, the market cap of Morien Resources is CAD $28.79 million. Morien has no debt and CAD $2.1 million in cash as working capital. The enterprise value (EV) is therefore approximately CAD $26.69 million.

Based on Morien’s Dividend Calculator, located on their website here, it’s fairly straightforward to determine their free cash flow (FCF), along with other metrics based on an 80% dividend payout ratio, and a 12% assumed dividend yield stabilization rate. I’ve included a suite of financial metrics for each of the potential outcomes in the tables below:

2023

2024

The bottom line boils down to how far into the future market participants are willing to underwrite Morien’s share price. If 2024’s production gets priced-in, then the implied share prices shown on the 2024 table are the likely outcome. Otherwise, the implied share prices on the 2023 table are the more appropriate range.

I have taken a probability weighted approach by assigning a probability to each of the potential outcomes above. However, since I’ve decided to make 90% of this article free, I’m reserving my personal conclusions for paid subscribers only in the section below.

If you found this write up valuable please smash the like button below and if you have any questions please free to ask. I find all feedback helpful.

Nothing in this Site constitutes professional and/or financial advice, nor does any information on this Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. The author of this Site is not a fiduciary by virtue of any person's use of or access to this Site or it’s Content.