Reiterating Buy on WHC

After a solid operational performance in 2025, the focus is now on the balance sheet and the met coal price

Whitehaven coal shares have been sliding since the company issued its quarterly Production Report on 25 July, with shares giving up almost A$0.90/sh from recent highs above the A$7/sh mark. Shares were rebounding in this morning’s trading on the ASX, up a couple percent from where they closed yesterday at A$6.37/sh (as shown in the chart below from 4 August).

I think that the decline in shares from recent highs is due to a few different factors, including a fall in the met coal price, a “muted” reaction to the recently-released Production Report, and high short interest in the stock overall. Bell Potter and Citi also downgraded the stock from a Buy to a Hold. Citi actually increased its price target (PT) by A$0.10/sh, however, to $7.10/sh, as last quarter’s production was slightly higher than expected and costs were slightly lower. Sell-side reports have been highlighting that production, cost and the Daunia/Blackwater integration are all in good shape, but analysts are getting a little nervous about the changing balance sheet or the met coal price. Short interest in WHC shares has recently been close to 3 year highs, as well, which may have driven some of the recent sell off.

When I last wrote about WHC a few months ago, the stock was trading around A$5.80/sh and I liked it. I’ve also said many times that it’s a core part of my portfolio, along with YAL. I have previously warned though that the capex plan and deferred payments to BMA/BHP for Daunia and Blackwater would dent cash flow for more than a year. I was also “bullish on WHC, but cautious on markets.” I think the rise in share prices over the last few months, even during a weak coal pricing environment, reflect the excellent operational performance from WHC management and the fact that management has been able to maintain modest share buybacks even with other demands on capital.

Positive Outlook for WHC Intact

My view on WHC remains largely intact - the only major changes are that the stock price is higher than when I last wrote and the met coal price looks as though it’s closer to bottoming and rebounding. I am increasing my PT for WHC from $8/sh to $8.25/sh as I increased forecasted mine output. I like to leave the met coal forecasting to Matt, but I think that PLV prices are at the 90% percentile of the cost curve and developing market growth is picking up slightly (mainly in India), so I’m hopeful that prices can start turning around. Morgan Stanley said something similar in a recent note.

Naysayers will point out that thermal and met coal prices aren’t doing great and while WHC makes small amounts of money at these levels, the margins aren’t anything to write home about. There were some rumblings out there that WHC needs to do even more on cost control (even though FY25 costs came in below guidance) and some moaning that Daunia and Blackwater aren’t the lowest cost or highest quality producers. (I’ve said before that these mines compete with “all but the top tier of met coal assets,” so they aren’t the absolute flagship mines in the industry, but they are very good assets). And of course there’s a lot of disdain for Queensland’s super profits tax.

Met Coal Rebound Can Drive Stock Higher

WHC isn’t the thermal coal cash machine that it once was as the cash is going to the Daunia/Blackwater deal and to capex. FY25 revenues were a 64%/36% mix of met coal and thermal coal. WHC's group average realized price of A$189/t was 5% lower than consensus, but was in line with my realized price forecast of A$183 for the calendar year. Now, a lot depends on whether the met coal price can make a turnaround in the next year, which I believe it can. With a modest rebound in the met coal price and a cleaned-up balance sheet (more below), WHC will be in a very different place in a year than it is today.

Balance Sheet Clears Up in 9 Months

There has been a little bit of consternation amongst analysts following WHC that cash on the balance sheet went from A$300 million at the end of 3Q 2025 to negative A$600 million during 4Q 2025. That was due to the US$500 million (~A$794 million) deferred payment that WHC made on the Duania/Blackwater acquisition during the quarter, minus about A$92 million in capex and a A$13.7 million share buyback. I think the debt load is well within reason, but it’s not a very exciting story for shares. The good thing is that the last big deferred payment of US$500 million to BHP/BMA occurs in April 2026, so investors don’t have to wait very long for the balance sheet to de-lever again. There’s just one more US$10 million deferred payment after that.

In sum, I am still holding WHC shares and I reiterate that they are a buy, even after a nice run up in the last several months. It may take some time for the met coal price to turn and for the balance sheet to get cleared up, but I think there’s ~25% or more upside to shares over the next year if we’re patient.

Since I haven’t gone through WHC’s recent June Quarterly report before, I do a quick review below:

FY25 Operational Highlights

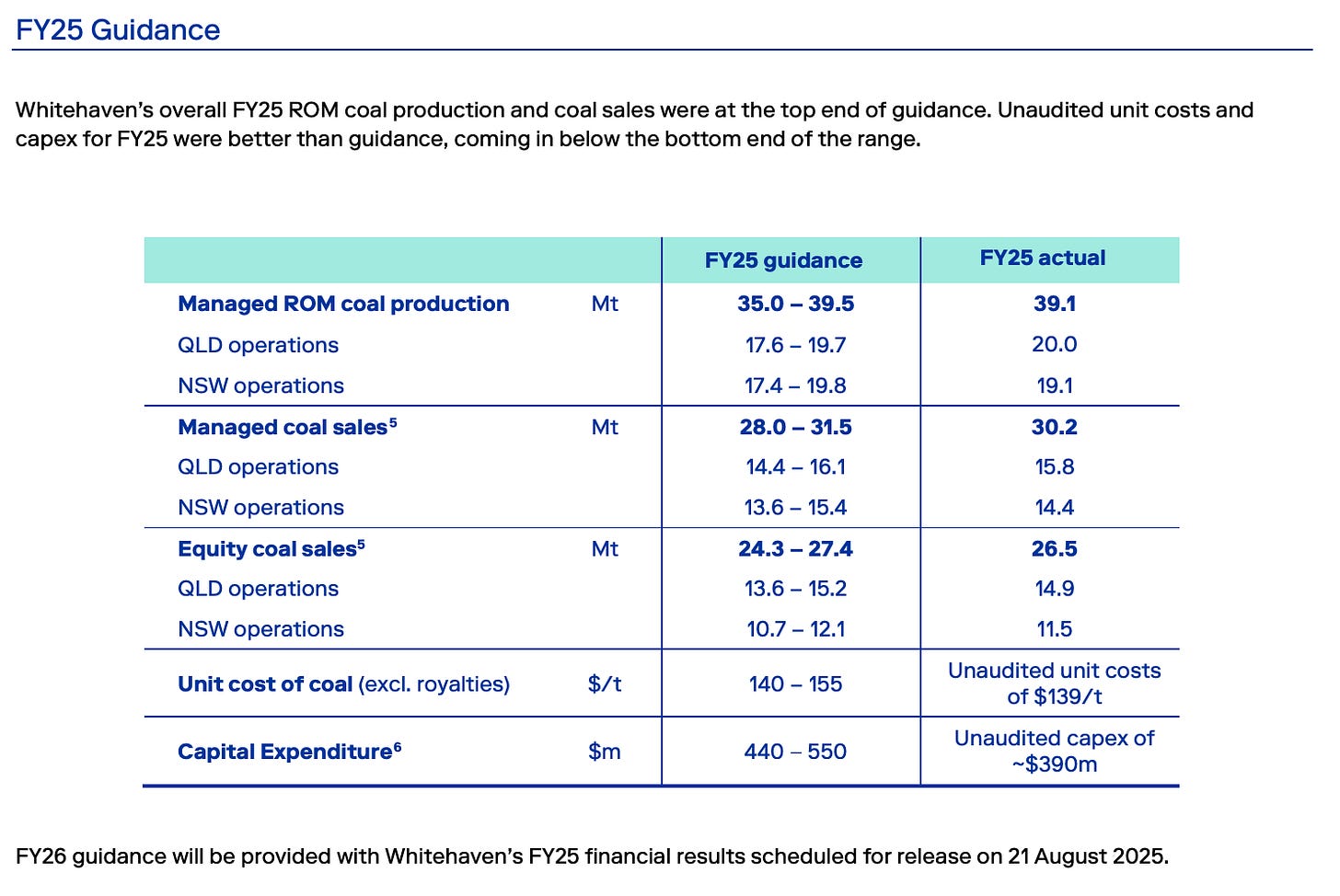

Good cost performance for FY25 unit costs at ~$139/mt vs guidance of $140-$155/mt.

FY25 ROM volumes of 20.0Mt exceeded the top end of guidance. Managed sales of produced coal of 15.8Mt for FY25 was towards the top end of guidance.

Capex for FY25 of ~$390M. Kept in check versus guidance of $440-$550M.

H2 FY25, 4.2M shares bought back for a total of $23.0M, so about $13.7M worth of shares were bought back last quarter.

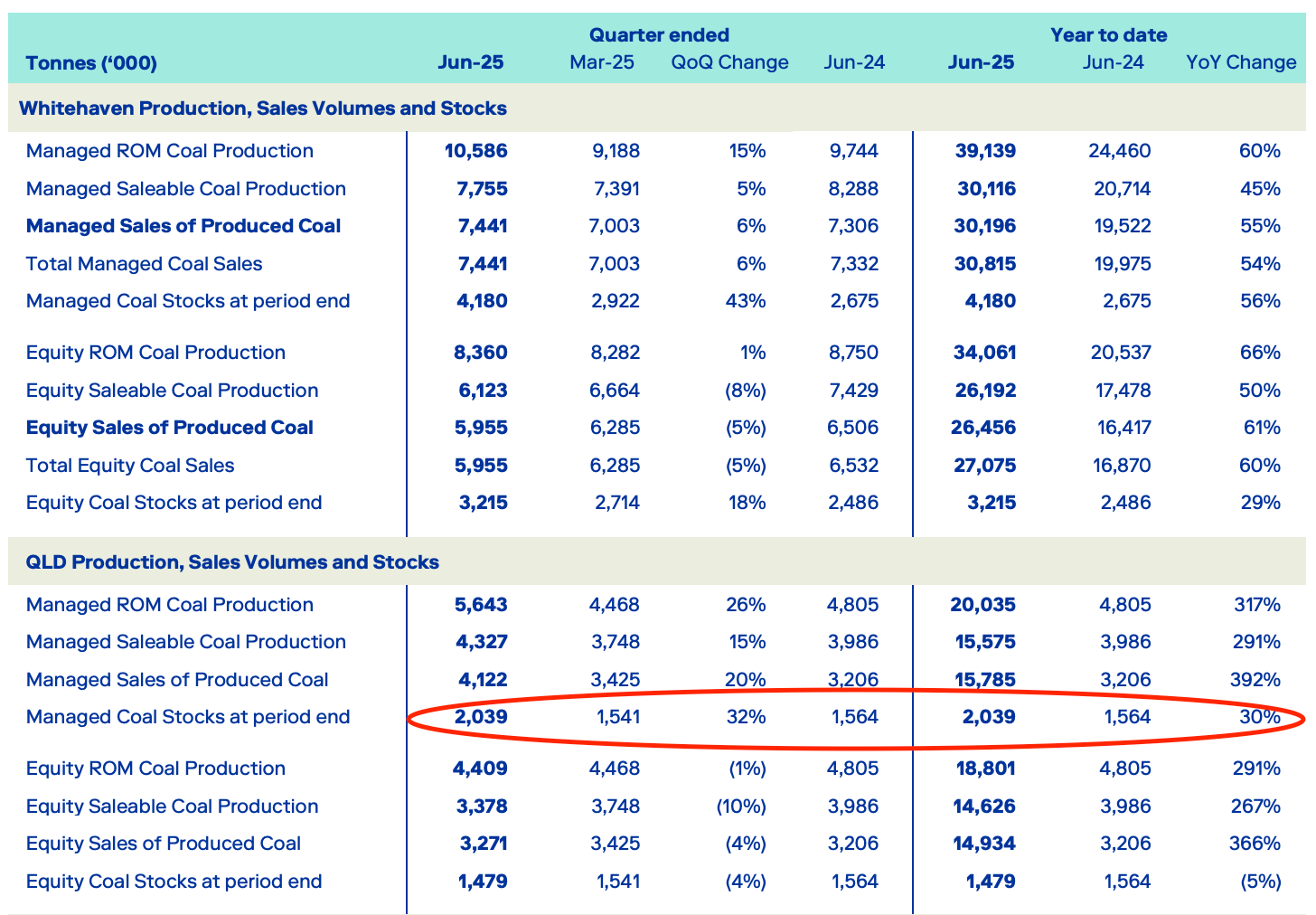

There was a bit of an inventory build from the Queensland met coal mines (see highlight below), which is likely a strategic move by management to wait for a rebound in met coal prices later in the year. On balance, I think the inventory build is a good thing, let’s hope that delaying sales a bit results in higher realized prices.

-JA

In such a volatile market as coal, 25% upside does not look a screaming buy. In my view, the margin of safety it is too narrow.

As a local i like it too. My biggest concern is the militant cfmeu union who who are unfortunately moving into the Pilbara and Coal fields, seeking to unionise the workforce. Very close to the government.