Peabody Acquires Anglo Coal Assets

Everybody Will Love to Hate This Deal, but There's Upside if They Can Execute

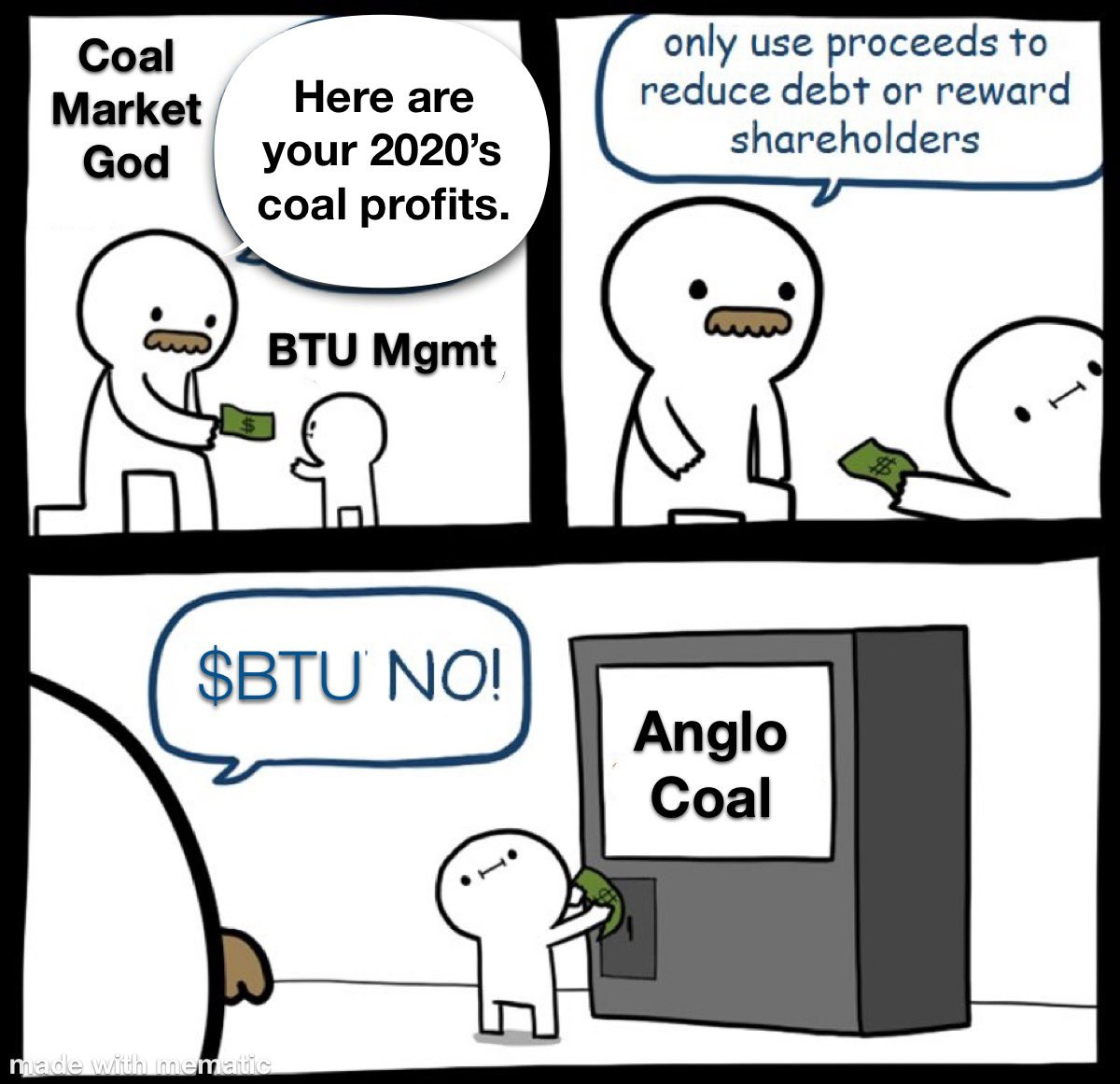

It has been incredibly hard to write on this topic today between catching up with an old friend from my Woodmac days and my phone absolutely blowing up with texts and DM’s that resemble this meme I posted to Twitter earlier.

So let’s just address the elephant in the room…no, this probably isn’t what BTU 0.00%↑ shareholders signed up for. Yes, they teased everybody with the $100M buyback, and Thomist swooped in to try and ensure/maintain that shareholder alignment. And now – seemingly to everyone in my DM’s, at least – it all went…

Bunch of haters out there, man!

Now, I don’t necessarily want to throw a wet blanket on the “bearishness” here, as I do think share prices will continue being volatile. And if you are a long only investor who measures success in terms of P&L over weeks/months/quarters, yes, there might be some rough road up ahead.

But neither the long term investooooors nor the degen traders should care too much. From those perspectives, this deal is either a blip over a 5-10 year period, or just another opportunity to use the resulting volatility to milk the BTU Secret Money Hack™ that has provided solid returns to those who have dared to play along.

So I know it’s super edgy to complain about management and yada yada yada and all the kids are doing it (including me sometimes…some of my past handiwork below). ↓↓↓↓↓↓↓↓↓

But let’s set all those emotions aside and just take a look at the deal, shall we?