This is a compilation of my notes for my met coal 2022 outlook.

The primary source data discussed herein comes from IHS’s Global Metallurgical Coal Supply and Demand Outlook. All volume figures are in metric tonnes.

Met Demand

IHS’s view is for global met imports (i.e. globally traded demand) to rise year over year (YoY) by 13.1 million tonnes (mt), or 3.7%. Of that amount, 11.1 mt is hard coking coal (HCC), 1.5 mt is semi-soft and semi-hard coking coal (SSCC and SHCC), and 0.5 mt is PCI. Let’s just focus on the total imports for now:

A couple things stick out to me here:

Mainland China - you can see the drastic fall in imports YoY from 80.4 mt in 2020 to 58.8 mt in 2021 primarily due to the ban on Australian imports. IHS is expecting a rebound of 9.4 mt in 2022, bring the figure to 68.2 mt. Since China is currently in a supply crunch, the 9.4 mt is not really a measure of demand, but more of a measure of incremental supply with the potential to be shipped to and utilized in China. If the market was well supplied, steel and coke producers in China would probably import an incremental 20 mt over what they did in 2021, which would put them back to their approximate pre-Australian ban baseline. So the first point is that with only an extra 9.4 mt of met supply, CFR China met prices should remain elevated relative to historical norms.

Therefore, as long as China is in a supply crunch prices will remain high. The latest prognostication for Chinese steel production which I heard is for it to be down 2% YoY in 2022. I do not think that will be enough demand destruction to mitigate the current supply crunch, even combined with the incremental 9.4 mt anticipated by IHS.

India - the rebound in India was substantial from 2020 to 2021, growing from 57 mt to 69.3 mt, but 2020 was an anomalous year due to Covid. A better measure of Indian growth would be the CAGR since 2018, which is approximately 4% per year. I’m not entirely sure why IHS has Indian demand falling YoY in 2022, but I do not agree with it. If you think back to early 2021, India was still struggling with Covid and the economy wasn’t rebounding at its full potential. I believe a conservative estimate would be to continue the 4% rate of growth YoY for 2022 which implies total met imports at 72 mt. India is a steel production growth story, and we need to account for it appropriately.

Therefore, IHS believes that China will import 9.4 mt of met coal in 2022 and I believe India will need an additional 2.8 mt. The rest of the countries on the list combine for an incremental 3.8 mt, most of which is from Brazil at 3.6 mt. This provides us with a total figure of incremental globally traded demand of 16 mt. However, this number remains artificial due to China being unable to import a satisfactory level of met imports. I believe China is still approximately 12.2 mt short by these estimates. Therefore, to balance world markets around 28 mt of additional met imports would be necessary.

Met Supply

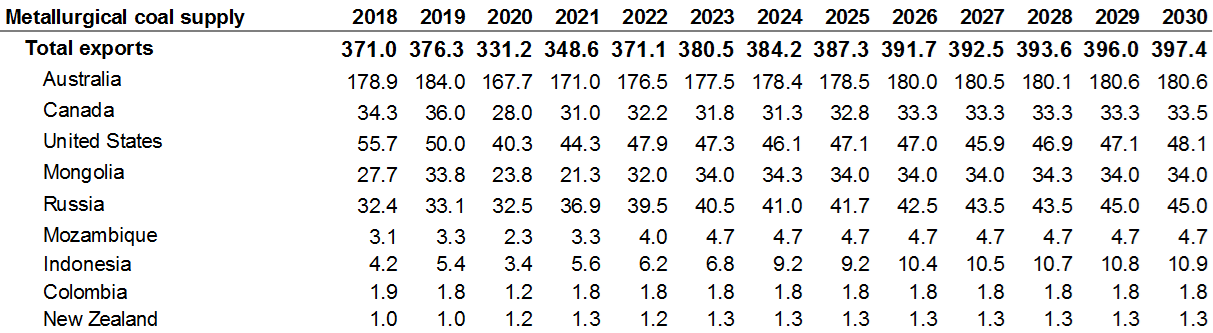

IHS’s estimates for global met exports (i.e. globally traded supply) in 2022 come in at 371.1 mt, an increase of 22.5 mt, or 6.5% YoY. Of that, global HCC makes up 15.4 mt (+7.4%), SSCC and SHCC is 4.3 mt (+5.6), and PCI comes in at 2.8 mt (+4.5%). Focusing only on the total exports for now, review the numbers below:

Two things also stick out here:

Australian incremental supply is only projected to be 5.5 mt. This number could be very low in my view. Here’s a list of potential sources of incremental supply in Australia:

AngloAmerican: Moranbah North and Grosvenor will combine for at least 2.7 mt of incremental supply.

QCoal Group: Byerwen Mine is ramping up from 3 mtpa to 10 mtpa sometime in the next few years. Let’s assume it produces an incremental 2 mt in 2022.

Vitrinite: Vulcan Mine Complex is expected to produce 2 mt of HCC and Karin is expected to produce 1.7 mt of high fluidity SSCC or SHCC.

These projects alone could combine for a total 8.4 mt of incremental supply in 2022.

Incremental supply from the US is projected to be 3.6 mt. This number could also be very low in my opinion. Here’s a list of potential sources of extra supply from the USA:

Arch: Leer South is expected to eventually ramp up to 2.7 mt. Let’s assume they’re only successful at getting 2 mt sold of that amount.

Warrior Met: Mine #4 is reopening and I’m assuming will produce at least 1.8 mt in 2022.

Peabody: Shoal Creek is reopening and I’m assuming will produce at least 1 mt in 2022.

Alpha Met: I expect Road Fork 52, combined with other small incremental sources of supply, to total approximately 0.5 mt in 2022. This supply will flex with the market however, so if conditions weaken materially I would not expect Alpha to have any increase YoY.

Ramaco Resources: Berwind is ramping up and they just announced the acquisition of Coronado’s Amonate Complex. I would expect an incremental 0.5 mt from Ramaco in 2022.

CONSOL: Itmann is expected to commence sometime in the back half of 2022 and will eventually ramp up production to 0.81 mtpa. This is probably more of a 2023 story, so I’ll leave this supply out for now.

Other: there are numerous other met producers in Appalachia with the ability to find sources of incremental supply, either by reopening idled production or increasing production rates. In that regards, I think an extra 2 mt is easily achievable however, markets/prices will dictate whether or not producers attempt these gains. If markets weaken significantly in the first half of the year I don’t think much from this bucket will materialize.

These projects/sources combine for a potential total of 7.8 mt of incremental supply in 2022.

Supply/Demand Summary

Given my adjustments for Australian and US potential supply increases, total incremental exports for 2022 come in at 31.9 mt, or +9.2%, as opposed to the 22.5 mt figure from IHS.

If you refer back to the Supply section, you’ll remember that approximately 28 mt of additional met imports would be necessary to balance world markets, including China. The 31.9 mt figure does just that with a little room to spare. This is an unfortunate fact but remember, if markets weaken early in the year as projected by the forward curve, producers will probably elect not to push for a lot of the incremental production discussed above.

Other Items of Note

Mongolia is estimated to provide 10.7 mt of incremental supply. This has everything to do with Covid and border shutdowns. If Covid abates, Mongolian supply could definitely rebound to 32 mt; 2019 supply was 33.8 mt. Keep in mind this coal is not of the premium variety so does not compete directly with US or Australian premium HCC.

Russian supply, mainly from Elga, is estimated to provide 2.6 mt of incremental supply, which sounds feasible. I’ve heard that Elga’s coal is also not of the premium variety so it’s yet to be determined how much impact it will have on supply.

Mozambican supply, from Vale’s Moatize, is estimated to provide 0.7 mt of incremental supply. This figure sounds low to me honestly, but I’m not too familiar with the situation there so I’ll defer to IHS. As I understand it however, Vale is trying to exit it’s position in Moatize and will likely do everything within their power to ramp production in order to aid in its sale.

Robindale Energy’s new longwall mine, Longview, is in development and is estimated to produce 3.6 mtpa once online. Production is anticipated to commence sometime in the second half of 2023 or 2024. Something to keep in mind for the future.

What Does It Mean???

All of the ins and outs basically line up to say that a YoY decrease in met coal prices is probably appropriate. If my supply adjustments are correct then prices should head back down to historical averages, plus whatever adjustments need to be added to take into consideration factors like increased shipping costs which are due to new trade flows generated in response to the Chinese ban on Australian coal. The key point to keep in mind, and I’m going to reiterate, China is in a supply crunch - the incremental supply discussed herein needs to be shipped to China or displace supply which can otherwise get shipped to China. If the supply crunch is not resolved, for whatever reason, prices will remain high.

In order for prices to remain elevated we basically need the stars to align and provide a significant number of the following. These items are mile-markers to keep an eye on throughout the year to see how the supply and demand balance is unfolding:

Post Beijing Olympics, Chinese crude steel production quickly needs to ramp back up. FY2022 needs to test the steel production quota limits again, meaning roughly flat to slightly up steel production YoY.

Strong steel production in China will most likely require the property market to either demonstrate surprising strength in 2022. Or China could offset any real estate weakness with infrastructure spending, perhaps associated with new forms of electricity generation (nuclear, solar, and wind turbines) which was talked about a lot post-COP26.

Indian demand needs to hit our +4% YoY demand mark. If the Indian economy can get going it has the potential to do much more. I cannot fathom a future where Indian urbanization doesn’t drastically improve over the rest of the decade. It will eventually require enormous amounts of steel and met coal.

For prices to remain elevated, US and Australian mines need to find it difficult to increase supply. This is very possible given current labor and ESG resulting constraints.

The market also needs economically stimulating fiscal and monetary policies worldwide to could keep the cycle going for a little longer. Fed rate hikes, for example, would not be conducive to economic growth and steel demand.

Keep an eye on Chinese domestic HCC supply. In 2021 Chinese HCC failed to ramp up significantly. Met prices need this source to continue to disappoint, and it would definitely help if it got even worse. This is actually a real concern given the State’s drive and focus on increased thermal production. Some crossover met volumes may get sold into steam markets in order for miners to meet production quotas.

We will obviously watch Mongolian, Russian, and Mozambican met mines and border/transportation logistic constraints.

Lastly, the Chinese ban on Australian coal needs to persist or met prices tank materially in my opinion.

Met Prices

Here’s the forward curve from early November. Please note that prices have begun to turn down already in the past week:

This chart aligns with the following annual prices:

The table above has the following for 2022 US East Coast Netbacks (FOB mine realizations):

US Low Vol = $207/ton

US High-Vol A = $187/ton

If you compare these prices to where US met producers announced 2022 annual domestic contracts, the above projections fall approximately within those ranges:

Arch = $230/ton (HVA, some LV)

Alpha = $192/ton (LV, some MV and HVA)

Ramaco = $196/ton (HVA and HVB)

My Best Guess

I anticipate a sharp selloff in met prices from now until the Beijing Winter Olympics, which takes place from Feb. 4 through Feb 20, 2022. I then expect Chinese steel production to begin ramping-up back to near full capacity over the following 3 months. The associated increase in Chinese demand should stabilize met prices until the summer. The back half of 2022 will be determined by the the 8 mile-markers I listed/discussed above.

The forward curve through the first half of 2022 is approximately in line with my expectations, although in reality I expect much more volatility to take place. If China’s steel industry steps on the pedal and Indian demand also shows up in the back half of the year, there’s a good chance met prices will remain elevated above the $200/mt level measured by the Australian coking coal futures on a FY basis.

Please let me know if you have any questions with regards to anything discussed in this post.

Nothing in this Site constitutes professional and/or financial advice, nor does any information on this Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. The author of this Site is not a fiduciary by virtue of any person's use of or access to this Site or it’s Content.

would you recommend getting out of the pure play met coal like METC and AMR and re enter in Feb ?

Great analysis as well! Thank you! On the other hand, you can hardly find a better time for high prices than September - November. The contracts for 2022 are almost done. Therefore, a short-term rebound in prices until February will not influence bottom line much. With current prices, some producers, taking into account dividends and buybacks, will bring next year as much as you pay now. So there might be risk focusing on the short-term movement to miss long term grow. There is still a chance that market won't be well balanced even in 2023. India will definitely grow faster (fully agree with you), Chine-Australia political issues definitely for years.