Initiating Coverage on Whitehaven Coal (ASX: WHC)

Tough market conditions right now for any new position in coal, but WHC poised for strong mid- and long-term gains

Australian coal producer Whitehaven (WHC) has been known over the last decade or more as a world-class thermal coal miner, but with its April 2024 acquisition of the Daunia and Blackwater met coal mines from BMA, the company has transformed into a hybrid thermal/met producer with a compelling outlook. Met and thermal coal prices are cyclically weak at the moment, so initiating new positions in any name right now may take some time to pay off, but I’ll be looking for entry points in WHC over the next few months. And the stock is already trading well below my calculation for fair valuation of over A$8/share (which seems to be around the the sell-side consensus price target from the few reports I’ve seen).

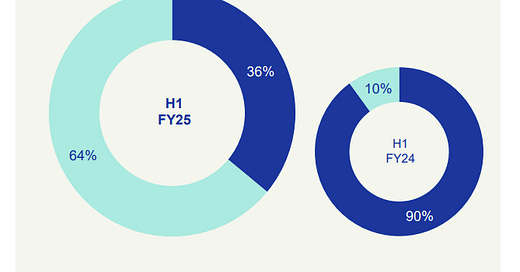

WHC Revenue Mix Shifting Towards Met Coal

Source: Whitehaven Presentation - Half Year Results FY25

WHC still has work to do integrating Daunia and Blackwater that they bought from BMA. They announced that they paid A$32 million in pre-tax acquisition-related costs in 1H25. And the company is still in the process of spending on organic growth capex that limits EBITDA and shareholder dividends in the short term (estimated through FY26). That and sliding coal prices are keeping share prices under pressure, plus, some investors may still think of WHC as mostly a thermal coal miner that faces energy transition risks. But the company has very long-lived, cost competitive assets, a balanced met/thermal portfolio, and is poised to produce durable FCF for many years into the future. At current share prices, it’s a compelling hybrid coal play with a close to 21% FCF yield, top among ASX-listed coal companies right now (see table below).