Initiating Coverage on New Hope (ASX:NHC)

Solid company, good dividend play and long-term hold that should appreciate on volume growth and the eventual rebound in thermal coal prices

I had meant to release this analysis of New Hope Corporation Ltd (NHC) last week, but a couple of things got in the way, then the 2 April tariff announcement happened and that took precedence. It is perhaps a strange time to be initiating new coverage, but I hope that you’ll find value in this analysis of NHC.

Right now, Matt and I have said that we’re in one of those periods where all equities (and asset classes for that matter) are highly correlated and the macroeconomic trends will largely dictate short term coal share prices. You can see in the chart below that NHC shares have generally tracked with other global thermal coal names and the SPY (an ETF that tracks the S&P 500 index) over the last 5 trading days.

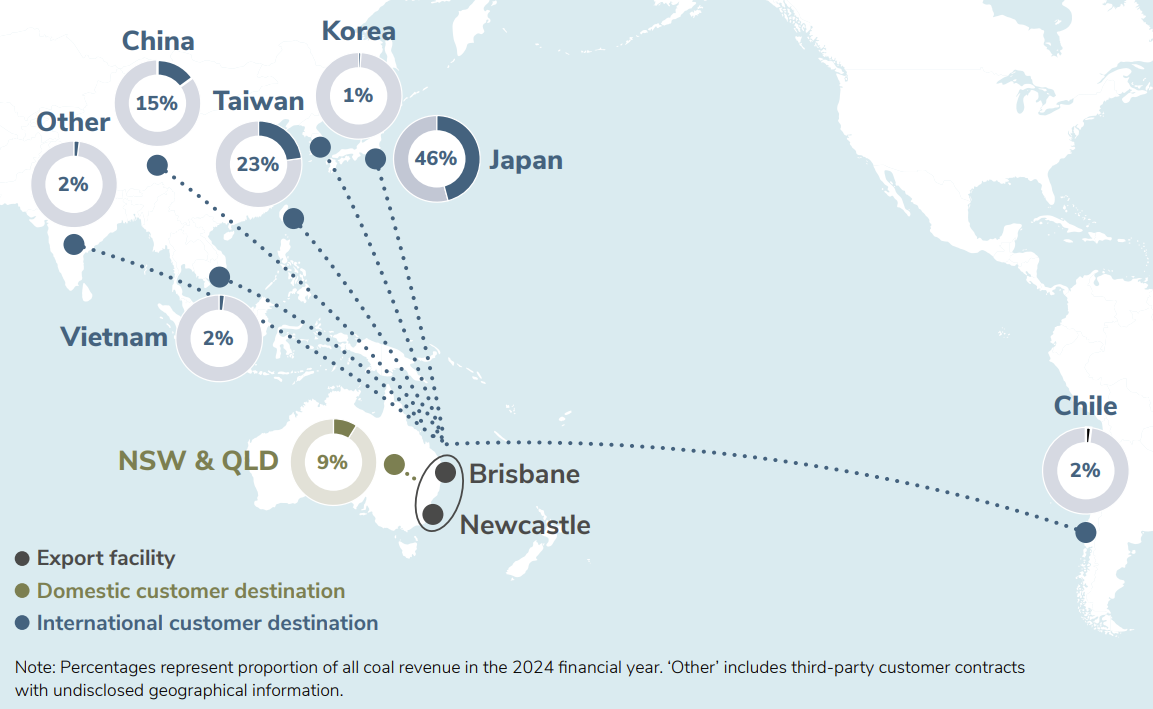

NHC is doing a bit better than other thermal-focused miners, perhaps because it sells a significant proportion of its output under term contracts, and is focused on exports to Japan, Taiwan, and South Korea (JKT). See NHC’s customer mix below, of which JKT made up 70% of FY24 sales.

Source: NHC 2024 Annual Report.

But WHC and YAL also do a fair amount of selling under term contracts. And all three have some exposure selling into China while trying to do the majority of their business with buyers in JKT. In sum, I don’t yet have a perfect explanation for why NHC shares are faring better than some of the other coal names at the moment.

Let’s get into the analysis and why I think that NHC shares should move gradually higher once macroeconomic and trade risks settle down. I know those macroeconomic risks are a huge caveat to any outlook, but I like to trade on the fundamentals. Picking up some NHC shares in the next few weeks could very well be a good long-term play if you have the stomach to ride out the trade war news.