Coal/gas switching in EU power market

How will a potential gas price increase this winter translate to coal prices?

With European gas rising ~14% over the last month from around EUR35/MWh at the TTF hub in Holland to currently trade near the EUR40/MWh mark, this has given headroom for API2 coal prices to rise while still keeping EU coal plant costs competitive with gas plant costs. Because EU gas prices can drive the API2 price, and the API2 price netted back to the US now drives a good bit of domestic US thermal coal pricing, the EU gas price can impact the share prices of the US thermal coal equities. So, it’s worth having a quick look to compare the economics of coal versus gas plants in Europe.

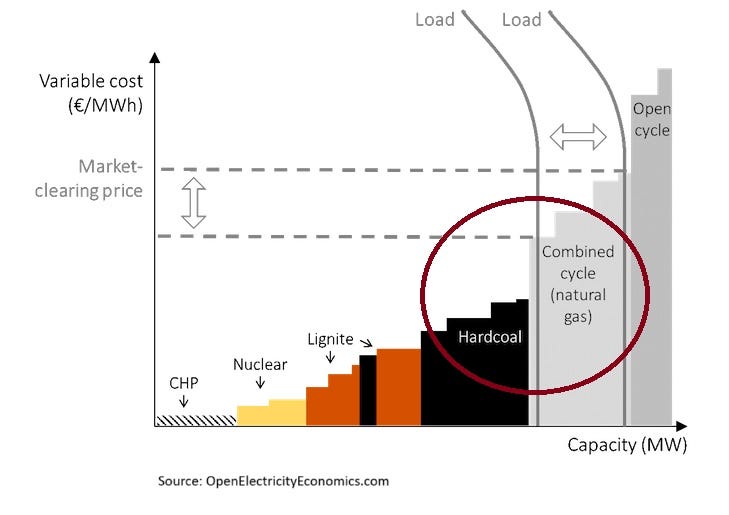

First, a quick primer on the power plant supply curve in Europe (see chart below). There are coal plants with a thermal efficiency of 40-45%, which are low-cost, pretty efficient coal units. Those are your baseload plants that are generally cheaper than gas plants, and they run all the time. As you move up the supply curve to higher cost power plants, you hit the older, less-efficient coal plants of 35% efficiency or so. Then you hit the combined-cycle gas turbines built a decade or two ago, which have an efficiency of about 50%. Those 50%-efficient gas plants and the 35%-efficient coal plants trade off on which one is cheaper depending on the costs of coal and gas. They also trade off on which unit runs and sells power into the market since they sit near where EU power supply/demand meet.