China Slaps 15% Tariffs on Coal Imports From USA

The First Casualty of "Unreliable Assumptions"

The ink isn’t even dry on our 2025 Metallurgical Coal Outlook and already we’ve predicted the future!

Well sort of…over the weekend I wrote:

In our newfound era of randomly sized geopolitical tariffs sized and implemented as if by whim, I suspect our industry will fare much better by quickly analyzing the results of such potential scenarios rather than to try and nail the short term fluctuations ahead of time.

I’ve gotta say I feel pretty vindicated having written that. Because after just three days, we’ve got a great example of an “unreliable assumption,” and our first scenario of randomly sized and implemented geopolitical tariffs to analyze.

Following Trump’s opening salvo of 25% tariffs on Canada and Mexico (which were resolved within hours) and 10% tariffs on China, a return volley finally arrived overnight, with President Xi ordering 15% tariffs to be applied to coal and LNG imports from the United States.

Obviously LNG will be a critical theme this year for the US, but that mostly affects thermal coal markets. And as such I’ll allow my Coal Trader colleague

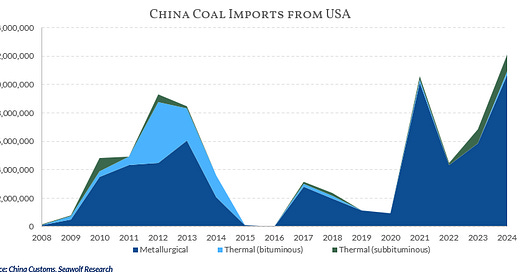

some time to analyze the knock-on effects.But most of the coal that China imports from the US is of the metallurgical variety, so that’s what we will be taking a look at here today…