CEIX, ARCH Merge to Create Core Natural Resources

BTU Activist Filing Tops Busy Week for Coal Industry

Of course I would choose to vacation the one week out of the year where the world’s largest steelmaker signals Big Trouble in not-so-little China, BTU 0.00%↑ gets another activist investor, and the largest US coal merger since Alpha-Massey 13 years ago goes down.

Well my little one and I have tickets to the 4-hour (!!!) Harry Potter musical so I only have a brief window of time before and after to pound something out, so here goes…

First, let’s address Thomist Capital’s 13D filing, which sent shares of Peabody up 7% pre-market this morning. The fund disclosed a 9.96% stake in BTU - 5.6% in the form of 7M common shares, and the remainder acquirable through call options owned by the Fund, the general partners, and Thomist founder Brian Kuzma himself. In the filing, Thomist suggests that they would like to see a more robust buyback plan, partially achieved by unlocking value in the PRB, and potentially selling down a stake in the company’s Centurion project (a la Whitehaven).

Given that none of those goals are immediately achievable, this is clearly a longer-term holding for the fund. And it comes at a time where the company could genuinely benefit from some sticky ownership. So while we will certainly find out more details over time, from this shareholder’s perspective it looks quite positive. And I’d be willing to bet the farm on the fact that they’ve got more interesting ideas than what was listed in that filing.

Now on to the merger…

ARCH 0.00%↑ and CEIX 0.00%↑ unveiled their definitive agreement to merge this morning in an all-stock transaction, thereby creating a new entity – Core Natural Resources (CNR, for now). The combined company boasts a portfolio of 11 mining operations across six states, including some of the largest, lowest-cost, and highest-quality coal mining complexes in North America. CNR's products will range from metallurgical to high calorific value thermal coals, catering to diverse markets, including steelmaking, industrial, and power generation sectors. And perhaps more importantly, the combined entity will also gain strategic access to global markets through ownership interests in two U.S. export terminals and connections to ports on both the West Coast and Gulf of Mexico.

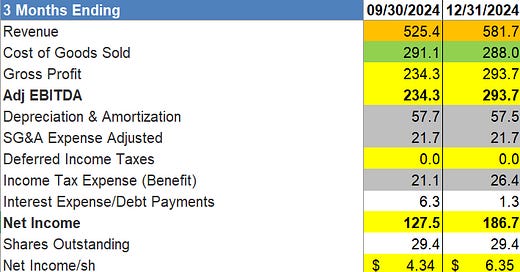

For the rest of the year, my as-yet UNADJUSTED (these are just plug-and-play numbers, people) models project a combined total of about $530M of net income.

Source: Seawolf Research

However, that is assuming all production targets are hit, and before we consider any synergies.

On that note, the most obvious benefit is that ARCH’s Leer and Leer South mines (and West Elk too) are now be shepherded by the best longwall operators in the world. And while Kittanning seam geology is notoriously difficult in that area of Taylor County, WV, I suspect that accessibility to additional in-region manpower and expertise will make a difference in terms of productivity.

The merger also allows for additional access to CNX Marine Terminal in Baltimore, and will likely deepen the overall relationship with CSX rail, both of which can add efficiencies and save on costs.

Similarly, ARCH’s Beckley low-volatile metallurgical coal operation in southern WV (which loads on CSX) is located just 40 miles from CEIX’s Itmann facility (which loads on the Norfolk Southern railroad). This provides CNR the flexibility to ship low-volatile tons on CSX to Dominion Terminal Associates in Newport News (where ARCH is a partial owner), or on the NS to Lambert’s Point, which has a larger throughput capacity.

If we assume even a small $5/short ton in cost savings from rail logistics across the 8 million short tons from Leer, Leer South, and Itmann, the result is around $40M in additional margin. Also, being able to move portloading costs from the expense column to the revenue column would be good for another $30-35M in margin for Leer and Leer South.

Just that exercise alone gets me to a hefty chunk of the company’s estimated $100-140M in potential annual synergies mentioned in the press release. And even assuming just a 2% benefit in reducing duplicate costs and overhead gets us the rest of the way there.

ARCH’s Black Thunder and Coal Creek mines in the Powder River Basin are really the only true head scratchers in the bunch – lower-quality surface mines which don’t reflect the combined company’s operating expertise. That said, if we are to believe Thomist’s comments on Peabody mentioned above, perhaps there is more optionality out West than we’re giving them credit for at this time.

The only other concerns are the respective buyback programs. CEIX’s in particular had become the industry’s most robust over the last few months, consistently putting a bid under the stock throughout shoulder season. While the PAMC assets are almost certain to have a fantastic back half to the year, that profit will now be deployed at a much later date across a much different share count.

And given that buybacks will be paused while this deal closes (likely not until early 2025) I suppose there’s a non-zero chance we could see a big pullback in share prices between now and then.

So in conclusion, there are certainly some aspects I like about this deal at first glance (logistics/port flexibility/cost savings). And there are some I don’t like so much (PRB exposure/unnecessary geographic diversity/pausing buybacks). But I’m inclined to say that CEIX CEO Jimmy Brock wouldn’t have let this deal go through if he didn’t think there was significant value that could be unlocked here.

For investors levered to short term performance, however, I would suggest some caution in the intervening weeks. While metallurgical coal markets will probably get off the schneid to some degree over the coming months, thermal coal markets will be heading back into shoulder season. And without the buybacks on to keep up the bid, there’s a chance we’ll see some weakness in each stock.

And to that end, it’s probably worth a quick technical analysis review of each company when I get back to the desk on Monday…promise to check with all the C-suites before I take any further time off!

Hi Matt - How do you think Core will operate buybacks going forward, once restriction against buybacks gets lifted? Will they be as aggressive as CEIX was?

What could be the benefit of no buybacks by either CEIX or ARCH?

The buybacks can give some share price stability against shorting and negative speculation.

Yes, it can also push the price up if too much but the agreement could have allowed for some buyback . They also are reducing dividends so that is another negative force.

So WTF am I missing here that made those two things to be good decisions?