BREAKING: Fire at Canada's Westshore Terminal to Impact Coal Exports

Expected slowdown in exports would put upward pressure on coal prices

Westshore terminal, a major coal export point just outside of Vancouver, BC caught fire today. It appears that the major fire impacted a stacker-reclaimer, which stockpiles and then distributes the coal into oceangoing vessels. The stacker-reclaimer that caught fire today, one of four such pieces of equipment at the terminal, is likely to be inoperable for a few weeks or longer, which will impact coal export volumes. If any part of the main conveyor belt at the terminal was impacted, not just a stacker-reclaimer, the export slowdown could be worse.

Thanks to TCT reader BGill for bringing news of the fire to our attention on Substack.

Westshore terminal projected exports of 26 million tonnes for 2024, and as of end-October it was on pace to exceed that target by around 1 million tonnes. An extended outage may tighten supply of certain grades of coal and support coal prices.

For much of its history, Westshore terminal predominately exported metallurgical coal from Teck’s Elk Valley Resources (EVR) mines in British Columbia and Alberta. I was lucky enough to visit the terminal and those Teck mines many times, so that’s how I remember the terminal operating. (ASIDE: Both the terminal and mines are in beautiful parts of the world (take a look at the photos at the end of this note).

However, in recent years, EVR, in which Teck sold a controlling interest to Glencore, has been shifting exports away from Westshore and towards the Neptune terminal in North Vancouver, BC. As EVR has shifted exports to Neptune, Westshore has become more reliant on exports of US thermal coal from two privately-owned mines in Montana: Spring Creek and Bull Mountain.

It is possible that met coal exports through Westshore could be shifted to Neptune, though that terminal is more space constrained and it’s not clear how much EVR met coal can be shifted there immediately. Shifting met coal exports to the terminal at Prince Rupert in northern British Columbia is likely to be unpalatable as that terminal is further from mines and more difficult and costly to access. For thermal coal exports, shipments through Prince Rupert are unworkable due to distances and switching rail lines.

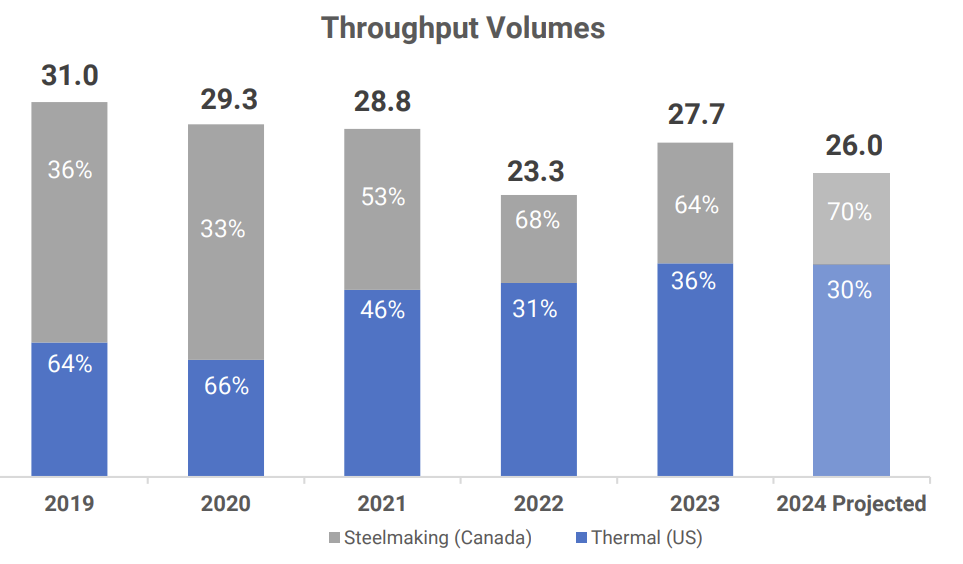

The following chart from Westshore’s Annual General Meeting presentation in June 2024 shows how the mix of coal exports has changed since before the pandemic. However, please note that the percentages for met versus thermal are incorrectly flipped on the chart (taken from Westshore’s presentation).

The US thermal mines that now make up the bulk of volumes through Westshore are high-cv, low-sulfur thermal coal mines that ship coal to northeast Asia (mainly Japan and Korea) under long-term contracts. See the mix of Westshore destinations (for all types of coal) below.

Though Asian high-cv coal prices have been in the doldrums in recent months as thermal coal supply has been adequate and winter in the region started out mild, an interruption of contracted volumes in Japan and Korea could send buyers into the spot market, which is atypical. That kind of abnormal buying behavior in what’s a small spot market in NE Asia (most volumes are contracted) is likely to put modest upside pressure on thermal coal prices. Though of course it’s hard to calculate the exact impact before knowing how much throughput at Westshore will be impacted.

Likewise, met coal buyers in Asia will see a disruption in contracted volumes from EVR. Though met coal s/d has been somewhat loose in recent months, if buyers enter the market to replace the excellent mid-vol HCC qualities provided by EVR, Australian coal prices will experience upward pressure from those bids. Met coal markets can be very sensitive to disruptions in supply of specific qualities of coal, much more so than thermal coal markets.

Matt and I will dig into the story more as details emerge and keep TCT readers updated.

-JA

Normal operation of the Westshore stacker-reclaimers can be seen in the image below.

When I visited Westshore, I was lucky enough to visit the beautiful site of the Elkview mine, now controlled by Glencore and pictured below.

https://www.zerohedge.com/commodities/natgas-futures-spike-ahead-forecasted-historic-cold

Together with Putin and Zelinkski’s latest gas throttling in europe, would this be the start of the yearly January coal rally?

Exhibit #1027 on why there are no upside surprises in Coal